Markets do not care about your energy level. The open rings, spreads widen, headlines pop, and your brain must keep a steady hand on risk, not just on coffee. Long sessions can drain attention, bias judgment, and pull you toward impulsive clicks. With a few smart routines, tighter risk guardrails, and, for some, carefully chosen nootropics, you can protect clarity from the bell to the close, and sometimes beyond.

Contents

Why Trading Days Burn Through Cognitive Fuel

Trading asks your brain to juggle numbers, narratives, and nerves at the same time. Understanding the drains lets you plan a steadier day.

Constant Context Switching

Price action, macro data, sector rotations, options flow, and chat alerts compete for attention. Each switch taxes working memory, which raises error rates when sizing entries or adjusting stops.

Stress And Loss Aversion

Stress chemistry narrows attention and makes losses feel twice as painful as gains. You are more likely to cut winners early and hold losers long. That is stamina draining and P&L unfriendly.

Glucose Swings

Skipping breakfast or hammering sweets invites a midday slump. Fog plus FOMO is a rough combo, especially during power hour.

Sleep Debt

Pre market reads after a short night bend risk perception. You may chase heat or freeze up, neither helps a plan.

Foundations That Keep Your Edge

Nootropics work best on top of simple, repeatable habits. These are realistic even on volatile days.

Sleep Banking And A Firm Window

On nights before key prints, go to bed earlier and protect darkness. A consistent sleep window supports reaction time and emotional balance, both vital when tape turns choppy.

Breakfast That Steadies Energy

Start with protein, fiber, and healthy fats, eggs with oats and berries works. Pair coffee with water. Stable energy reduces the urge to fix boredom with trades.

Movement And Light

Two to five minutes of daylight and brief mobility early in the day wake the nervous system without a spike. Every hour, add a 60 second stand and stretch. Better posture helps thinking feel less cramped.

Information Diet

Pick a short list of signal sources and mute the rest. Too much chatter builds anxiety and FOMO. Curate, then commit.

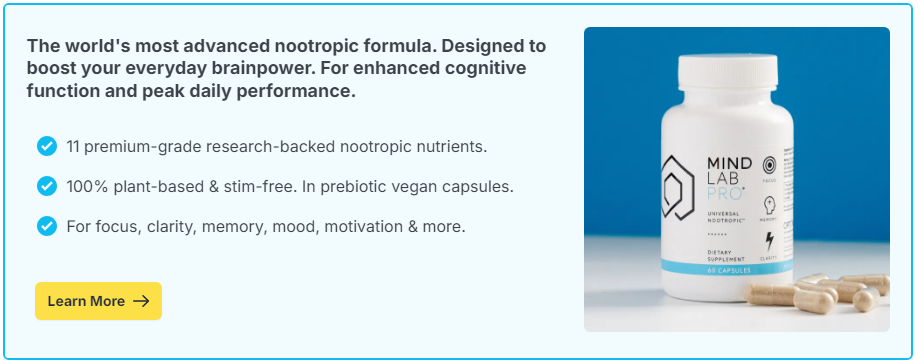

Nootropics That May Support Long Sessions

These ingredients are discussed by professionals who want calm focus, clean mental energy, and steady memory during high stimulus work. This is not medical advice. If you have a condition, are pregnant, or take medication, speak with a clinician first. Start low, add slowly, and track how you feel.

L-Theanine With Caffeine For Calm Focus

L-Theanine, found in tea, promotes a relaxed alert state. Paired with a modest amount of caffeine, it can smooth jittery edges while preserving attention, useful during fast moving open or news spikes.

Citicoline For Crisp Mental Energy

Citicoline supplies choline for acetylcholine production and supports cell membranes. Many users report cleaner engagement and less mental drift, a fit for long stretches of chart review and note taking.

Phosphatidylserine For Task Switching

Phosphatidylserine is a structural phospholipid in brain cells. It is studied for memory and stress response, and is often chosen when flipping between watchlists, DOM, and risk sheets.

L-Tyrosine For Acute Strain

L-Tyrosine is a precursor for dopamine and norepinephrine. During sleep restriction or peak stress, some traders use it earlier in the day to support working memory during rapid decision windows.

Rhodiola Rosea For Perceived Fatigue

Rhodiola is used to support stress resilience and motivation. Earlier day timing is common on heavy calendar days with multiple catalysts.

Bacopa Monnieri For Retention

Bacopa is commonly used for memory. Effects are gradual and tend to build over weeks, which suits ongoing study of playbooks, macro primers, and sector notes.

Lion’s Mane And Maritime Pine Bark Extract

Lion’s Mane is popular for general cognitive wellness interest, and maritime pine bark extract is valued for circulation support. Both appear in comprehensive formulas along with Citicoline, L-Theanine, and Phosphatidylserine.

Match Tools To The Trading Day

Different windows require different mental modes. Use this template, then personalize with a simple log and your risk rules.

Pre Market Routine

- 30 to 45 minutes before open: Daylight, water, and a brief mobility set. Review the plan, A setups, key levels, catalyst times.

- Caffeine strategy: If coffee causes jitters, pair with L-Theanine. Some analysts find Citicoline helpful during the first chart review block.

- Risk rehearsal: Say stops out loud. Visualize the worst trade of the day and your correct response, flatten, journal, reset.

Open To Midday

- Focus filter: Watch only tickers that match your plan. Hide P&L if it pulls you off process.

- Breaks on a clock: Every 60 to 90 minutes, stand, breathe, and sip water. Short breaks prevent sloppy entries that come from fatigue.

- Nutrition: Balanced snack around midmorning, yogurt with nuts or fruit. Avoid sugar bombs that crash during lunch hour.

Midday To Close

- Recalibrate: Update levels and scenarios. If fatigue builds, earlier timing of Rhodiola may help some people. Skip late caffeine to protect sleep.

- Playbook, not improv: During power hour, only take setups you planned. Fatigue loves improvisation, and improvisation loves regret.

- Post close: Brief journal, lessons, and screenshots. Mark one thing to test tomorrow.

Risk Guardrails That Save Energy

Good guardrails preserve attention by reducing internal debates. Less debate means more bandwidth for reading tape.

Position Sizing Rules

Use a fixed percent risk per trade and stick to it. Sizing by feeling drains energy and invites tilt after a loss.

Daily Loss Limit

Set a max draw for the day. When hit, flatten and switch to research or practice. This protects capital and preserves mental health.

Stop And Target Placement

Pre define stops and first targets based on levels, not hope. Enter them as orders when possible to reduce decision fatigue during fast moves.

Decision Journal

Log context, thesis, entry criteria, exit rules, and emotional state. Reviewing weekly reveals bias patterns, such as revenge trading or fear of re entry.